Your Debt Free Journal

As counter-intuitive as it seems, a certain amount of debt can actually be a good thing, when it's used strategically. Shopping around for the best mortgage rate, for example, is absolutely a good use of your time. However, if you're a credit card holder whose household carries the average amount of credit card debt ($10,479!), that's a different story. That debt can cost you a lot of money over time, it can damage your financial well-being in other ways, and it can damage your emotional well-being, too.

Let's not underestimate the impact of your financial life on your emotional well-being here. Debt can be frustrating, exhausting, or overwhelming. And you don't deserve that! You deserve security, peace of mind, and abundance. You're worth it.

And that's where a debt free journal comes in.

Why A Debt Free Journal?

Like with anything when it comes to personal finances, your debt free journey is likely to take some time. You're (probably) not going to make a few simple changes and notice no debt the following week. You need somewhere to create your action plan and visually track your progress.

Here's how to get started!

How to Start Your Debt Payoff Journal

First, get a notebook, bullet journal, or blank journal to use as your debt free journal. You want to have a separate space for gathering information, keeping a debt tracker (or two...or more), making notes, journaling, and tracking your overall progress.

Tip: Choose a journal that appeals to you. If you like it, you'll be happier when you pick it up!

Set up a spot for working on your finances where you can journal. If you don't have a ton of space, this could be a drawer or folder that you can access easily. Consider making your journaling spot peaceful and encouraging, whatever that means to you. (For us, it's a really good candle and a snack. Not being hangry can save lives.)

Next, decide how often you will open your journal. Will this be a weekly journal, a monthly review, whenever you get paid, or even a quarterly check in? The key is to find a healthy rhythm for you. You absolutely deserve a peaceful, purposeful life, and obsessing over debt will not support that. (No thank you, Dave Ramsey.) Plus, it can distract you from other important aspects of healthy finances, like increasing your net worth and bringing enough good things into your life to make this a sustainable practice. You are going to do some initial setup and then use your journal for systematically reaching your goals. Make sure you check in with yourself regularly to make sure this process is helping you find balance.

(There’s a downloadable debt free journal on our Etsy page if you would like a printable version!)

Create Your Action Plan

So here's the plan: You're going to make a monthly budget that involves spending less than you earn, and you're going to track your spending to stick to it. You're going to get to work on an emergency fund. And then you're going to tackle that debt.

And throughout it all, you're going to remember that this journey is about the progress.

Ready?

Tally Up Your Debt

In the first section of your debt journal, we need to see where you financially stand today. Make a list of every debt you have. Include the amount you owe and the annual interest rate you're paying. Include everything: credit cards, student loans, car loans, even the $50 you borrowed from your sister. Write it down.

Calculate the total. It's okay if it's a lot of money; the first step to managing your finances is to know what they are. Also, heads up that this might be the hard part.

Before you go any further, take some time to sit with this list. In your journal, ask yourself a few questions to bring clarity to your debt free journey:

Do you have an emotional reaction to any of the debts on this list? Which debt is it?

This might sound odd, but are there any debts on this list that you're grateful for? Before you spend the next year (or however long) pretending this debt is your enemy and battling it down, take a moment to acknowledge that accruing the debt might have given you something good or something you needed at the time.

Can you learn anything from anything on this list? What is it?

How much are you paying per month, on average, to maintain this debt? Add up your average interest payments and service charges and circle that number. (Multiply it by 12 to see what it looks like over a year.) Imagine, when this is over, having that much extra money in your monthly budget. What will you do with it?

Address the Payment Numbers

Go through your debt list one line at a time. Is there any room to call and negotiate a lower rate on any of them? If you've paid your payments on time and the company that issued the debt is interested in future business with you, they might manage to see their way to giving you a break.

Put Your Debt List in Order

Now look at the debt list as a whole. Your next task is to reorder the list by the order in which you want to pay off your debts. Assume you'll be paying the minimum payments on each debt; presumably, that's already part of your monthly budget. (If it's not, go revise your budget!)

Some people like to pay off debts from highest interest rate to lowest. Some people like to pay smallest amount to highest. (You deserve the early win!) You might have other reasons to work something in: Maybe that home improvement store card only gave you a 0% rate if you pay off the dishwasher within 12 months. Put it on top. Maybe you just want to finally pay your sister $50. It's okay to prioritize her.

Write out your debt list in the order you decided on in your debt free journal. If you live the bullet journal lifestyle, make this page visually interesting, because you may be returning to it often.

Your job is to then dedicate every extra dollar (after each debt's monthly payment) toward paying off the debt on the top of the list, then move to the next one. Really focus on one at a time. This is called the snowball method because it's reminiscent of a small snowball rolling through the snow into a larger and larger snowball.

Decide on Your Rewards

Don't skip the following step: You need to reward yourself every time you hit a milestone. Choose your first prize now, at the outset, so you have something to look forward to, be specific, really visualize it, and write it down. And when you get there, deliver. If you get there within a slightly aggressive timeframe, upgrade your reward. For example, you could write in your debt free journal:

When I have paid off my home improvement store credit card debt, my husband and I will go out to my favorite Mexican restaurant. We will toast our new fully owned dishwasher with margaritas and the best guacamole in town. If I pay it off before October 1, we will bring home breakfast for the next day from the bakery next door to the restaurant.

Again: This won't work if you don't deliver. So deliver!

In the meantime, reward yourself for the little milestones too. It may be uncomfortable at first (ask yourself why), but get in the habit early so you can avoid getting overwhelmed. Every time you write a check, whisper “I deserve abundance” or “I deserve to be debt free” into the envelope before you seal it. Or tell yourself “I'm proud of you” in the mirror. You should be proud of yourself, and you do deserve to be debt free.

Begin Working on the First Debt

Turn to a new page in your debt free journal. At the top of the page, write out the amount of money you need for your current debt payoff goal.

Create a visual tracker that you can use to see your progress. Color it in as you go, and keep it up-to-date.

Underneath the tracker, journal some ideas. The rule of brainstorming is, there are no wrong answers. So let yourself write whatever comes to mind, and don't stop to judge your ideas. Can you increase your income or reduce your expenses to allow more money for paying your debt?

Once you have a lot of ideas written down, it's time to set a goal.

How to Set an Achievable Financial Goal

Goal-setting is something of an art. If you’ve written down dreams only to find the paper months later and laugh, don’t worry. It takes some practice!

Anatomy of a Goal

As soon as you start goal-setting, you will probably run across someone in the business or personal development worlds talking about SMART goals. (Here's more about SMART goals from Forbes.)

SMART usually stands for:

S: Specific

M: Measurable

A: Attainable

R: Relevant

T: Time-bound

There are a few variations on this acronym out there, with people arguing about what’s the most effective and everything. Here’s a very quick intro.

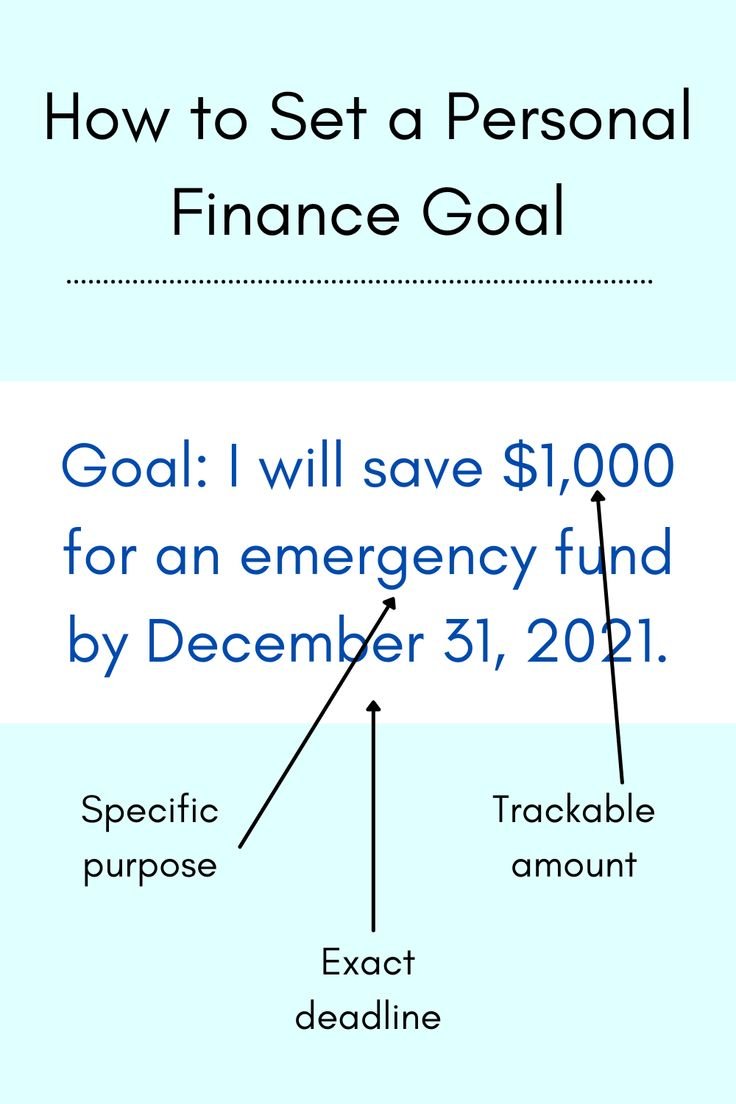

Specific/Measurable: What is your big-picture goal for your debt reduction? Think about it, and then start refining it to be as specific as possible. Use measurable numbers that you can calculate and track. For instance, you might set a goal to pay off a certain percentage of your student loan debt over the next year.

Time-bound: Draw yourself a timeline. Where do you want your debt snowball to be in five years? To get there, where do you want to be in one year? To get there, where do you want to be in the next quarter (three months) of the year?

Relevant: Are your goals going to help you achieve your big-picture dream? And—this is important—do they rely on YOU? That is, you can set a goal to apply for a new job, but you can’t make a goal to get a new job, because that relies on someone else hiring you.

Attainable: It’s okay to push yourself a little, but is your debt snowball goal actually possible? And is it possible on the timeline you’ve specified? On the other hand, don’t make it too easy. Find the right balance!

Make a Plan

Now it's time to put your goal into action, because a goal without a plan is just a hope. There are a lot of ways for you to do this, and exactly how you do it is up to you. Maybe you'll put aside a certain amount every time you get paid or save a certain amount each time you earn extra money. (After you make the minimum payment on each of your debts, of course.) Whatever your debt goal is, put your road map in place and set up your habit trackers in your debt free journal.

And then go get it! If it helps, use your debt journal as a weekly journal to check in with your debt tracker, your life, and how you feel your debt journey went that week. It can motivate you to keep the snowball method in mind as you work toward marking that first debt paid. Stay in control.

And remember, this is about balance. If you have to take a break when something comes up, get back to tracking as soon as you can, but forgive yourself and don't feel guilty. It's a journey; not something you would have gotten fully paid in a week if something hadn't come up.

Repeat as Needed

When you've achieved your first debt goal and rewarded yourself, you've started your snowball! Congratulations! Keep the snowball method going with the debt you decided to put in second place.

Finally, make sure to balance your debt free journey with other ways to increase your net worth and begin to take control of your savings and investments.