Analyze Your 50-30-20 Budget

If you've taken any steps into the personal finance world, you may have heard of the 50-30-20 budget strategy. We first heard about it from Elizabeth Warren and Amelia Warren Tyagi in their book All Your Worth. It's not new, and it's not instant, but it's effective!

If you use a different budgeting method, app, or accounting method day to day and that works for you, that's great! You don't have to completely change over to the 50 30 20 budget rule. But even so, you might be able to gain some valuable insight on how to achieve your financial goals by analyzing your budget by using this method.

The 50-30-20 budget is all about balancing your needs, wants, and savings. The benefits: It gives you a snapshot of how healthy your overall spending is. If your needs or wants are too high, you might be stressed out about making it to the next paycheck. If your savings and debt repayment percentage is too low, you might not be saving enough or doing enough debt payment. If your wants percentage is too low, you might not be enjoying your life, which makes your budget unrealistic because that can't last.

Of course, your mileage may vary! But this budgeting method is an easy way to give yourself your next personal finance targets.

Divide your monthly expenses into needs, wants, and savings:

Needs

Are you obligated to pay something? It goes into the needs box.

Savings

Put your savings, such as your emergency fund, and debt repayment amounts that are more than the minimum payments into savings.

Wants

Everything else goes in wants.

You can use this printable template for the 50-30-20 budget method if you would like. (Here it is as a PDF.) Or you can use a spreadsheet, your journal, or a scrap piece of paper. If you'd like to use our spreadsheet template, see below!

Add up the total in each of the 50-30-20 budget rule categories, and then add up all three categories to get your grand monthly spending total.

Needs: $_____

Wants: $_____

Savings: $_____

Total (Needs + Wants + Savings): $_____

Your goal is to get your needs to under 50%, your wants to about 30%, and your savings and debt payments up to 20%. How are you doing now?

Needs (Needs / Total): _____%

Wants: _____%

Savings: _____%

As you make your plans for reducing spending, debt reduction, putting more money in your savings account, and adjusting your bills, keep these proportions in mind. Will you be able to take a step closer to the 50-30-20 budget rule? Revisit this in a few months and see if your personal finance numbers have improved.

How to Use the 50-30-20 Budget Spreadsheet Template

If you're a spreadsheet type (hi, friend), you're welcome to use this 50-30-20 budget spreadsheet template (download as an .xls here). Spreadsheets are great friends of a percentage based budget.

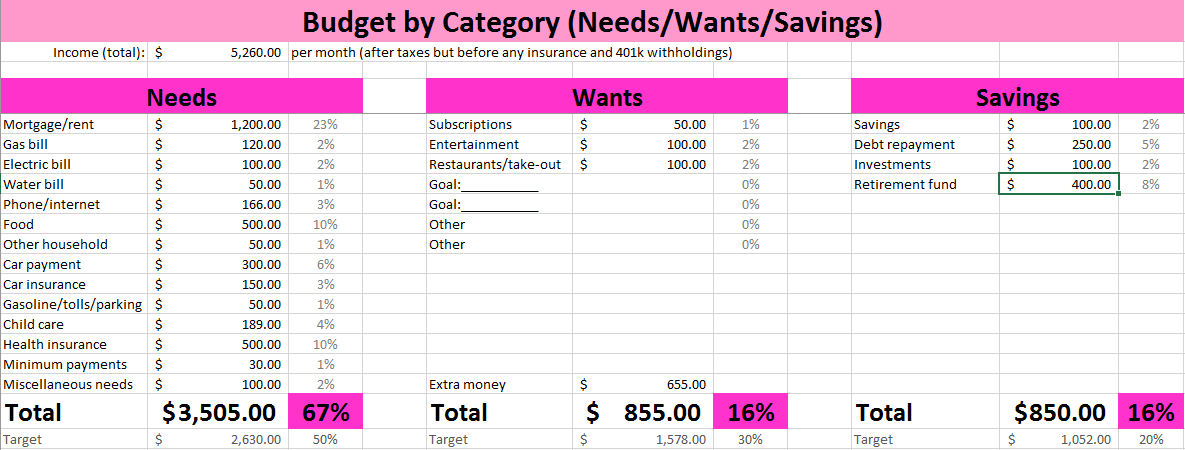

It will look like something like this (these are hypothetical numbers) when you fill it out. After entering your monthly household income and how much you spend on your needs, wants, and savings and debt repayment, look at the percentages in the pink boxes. How close did you get to 50-30-20?

Here's how to use the spreadsheet.

After Tax Income

Start by entering your monthly income here.

The full amount of money you get paid before taxes is called your gross income. For our purposes, we're more interested in your net income, which is the amount of income you get after taxes. So start with your take home pay, also called your monthly after-tax income or net pay.

Calculate based on your monthly after-tax income, but do add back in any deductions that might regularly be taken out of your paycheck. That is, if you have retirement contributions or automatic payments for health insurance and dental insurance, those count as savings and needs, so include them in your percentages! That's your take home pay plus any money that doesn't hit your bank account but is going toward your living expenses and financial goals.

Tip for Later: Make More Income

Increasing your income is always going to make the 50 40 20 rule budgeting categories look better. Think about how you can get a raise or another income stream to increase your after tax income. It will improve your overall financial health and make your budgeting of the following three categories a lot easier! And you absolutely deserve that.

Needs Category

Next, add the essential expenses you would classify as needs to this column.

This is where you're going to account for your living expenses like your rent payment and insurance premiums, your minimum debt payments, and other necessary costs. These will depend on your personal circumstances, so make the best budgeting system for you.

If a row doesn't apply to you, feel free to right-click and delete, or to change the line item name. And insert as many rows as you need. As long as you're obligated to spend money on it, it goes in this section. If the total percentage in the pink box is more than 50%, look for ways to cut the expenses in this column.

Sadly, given the economy that you're working on your finances in, this budget is likely to be coming in higher than the 50 30 20 rule suggests. This is where a lot of people struggle. That's not your fault, and we feel for you.

So it's time to work on your financial skills and money management! This is where budgeting, reducing expenses, taking public transportation, and using techniques like the envelope system can help you get started. You deserve to have an easy budget, so find places to save money and get started.

Wants Category

Divide your wants expenses however best makes sense for your budget. This is your disposable income. We like having a subscription line (love our streaming services) and a line for saving up for Christmas expenses, for example. The goal here is 30%, so look for ways to reduce it if the percentage in the pink box is more than 30%.

Note that the “Extra money” line is any unallocated money after you fill out the needs column, the savings column, and the rest of the wants column. It's the income you put in minus everything else. Feel free to add that amount of money somewhere else if you want to give every dollar a budget category. In any case, your goal is to make sure it's not a negative number; that will mean you're spending more than you earn.

Savings and Debt Repayment Category

Enter your savings, debt repayments beyond the required minimums, and investments. This is where you'll save up for an emergency fund, contribute to your retirement savings, save for major expenses that will help you achieve your financial goals like a down payment, and contribute to long-term investment accounts.

If the percentage in the pink box is less than 20%, look for ways you can raise it. How can you save more or reduce more debt?

And if you can automate any part of this, do it. Have a portion of your paycheck go straight into a savings account or tax advantaged accounts for retirement via direct deposit. If you don't see it, you won't forget to transfer it or spend it on unexpected expenses. Have debt payments taken out of your savings accounts automatically, if you can. But if necessary, do allow credit card payments to go into your checking account so you can pay off your variable credit card debt. Just automate what you can.

Tip: Try to Match the Percentages

See those light gray percentages to the right of numbers you're entering? If you like, you can use them to see the percentage of your income that any of your line items is. The closer to the 50 30 20 rule you can get them, the better!

More on Wants

Sometimes when you're struggling to stick to a budget, it can make you feel guilty to spend on something that, when compared to your water bill or retirement account, can seem “frivolous.” This is also the category in the 50 30 20 rule where people tend to think about their spending habits and start getting hard on themselves.

We don't want that! This is about balance, not denial. So let's celebrate some of the wants that have made you happy. Here are some journal prompts to get you started.

Celebrate Your Favorites

Think about your spending over the last year. What is your favorite big want (a vacation, new television, or something else big!)? Why?

What is your favorite small want (the latte or scented candle or another everyday luxury you love)? Why? Is it accounted for in your monthly budget?

Get the Lay of the Land

What's your current wants budget? (If it's 30% of your total monthly income, that's awesome! If not, put down what it is for now.)

What amount of that is recurring, and thus accounted for already? (This includes your Netflix account, your makeup subscription box, etc.)

How much of the budget is left over for other expenses?

And how does your monthly wants budgeting reflect your financial values and the things that matter most to you? Given that this is a limited budget, is there any reallocation you could do to make sure you're budgeting for what matters to you and what makes you the happiest? (For example, maybe you never use that Netflix subscription...but you would never give up spending on the makeup subscription box.) Your finances should reflect your values!

Dream of Your Future Goals

Make a list of big wants. Go wild! What's on your bucket list? You know what they say: you can do anything (if not necessarily everything). Pick an item on this list and research it. How much money would you need to be budgeting to make it one of your goals? How long will it take you to save up for it, if you put aside part of your wants spending every month? How much would you be putting aside? Set some savings goals and start saving, dreamer!

What's Next?

With any luck, analyzing your budget using the 50-30-20 budget method will help you narrow down your next personal finance goals. Whether you want to reduce debt, make a better budget, reach your savings goals, or increase your income, we know you can improve your financial situation. Good luck!

As you take your financial journey, here are some money mindset journal prompts and other financial well being articles to get you started.